Can you tax-loss harvest your bonds? Learn how BlackRock can help

4.7 (404) In stock

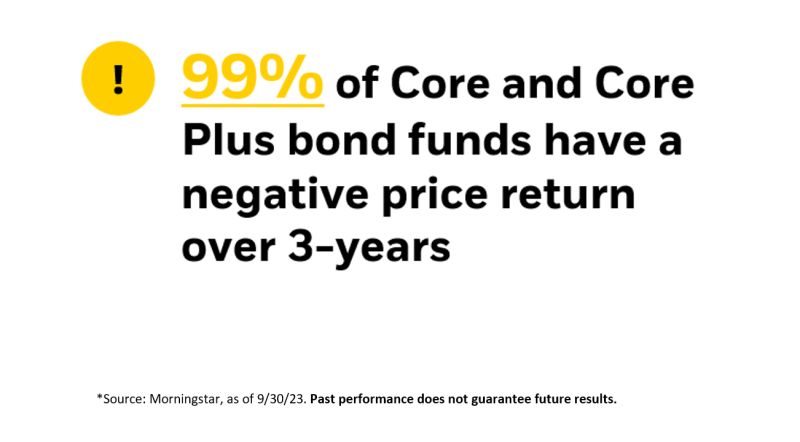

Did you know that 99% of Core Bond funds have a negative price return over the last three years?* This means there can still be an opportunity to tax-loss…

Top Tax-Loss Harvesting Opportunities in Bonds and Sectors

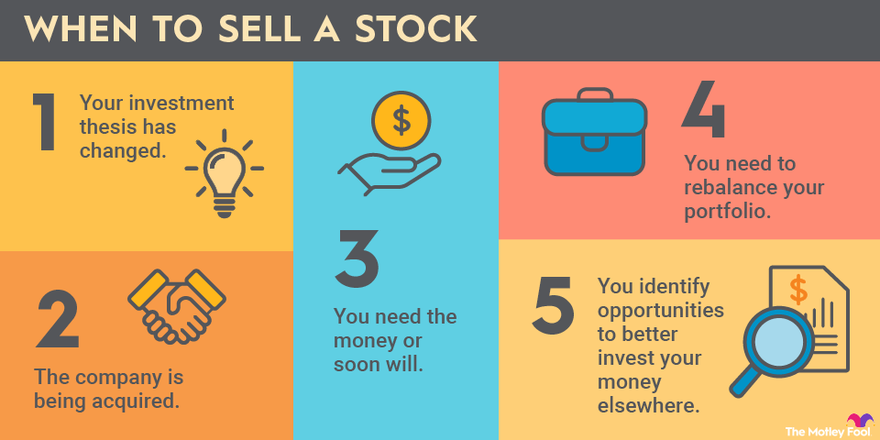

When to Sell Stocks — for Profit or Loss

What Tax-Loss Harvesting Is and How It Can Boost Returns

Tax-loss Harvesting in Cryptocurrency: Rules to Use to Your Advantage

Tax Harvest Myths: Don't direct indexit just delays inevitable

Your Investment Lost Money Last Year. So Why the Big Tax Bill

How BlackRock's tax-smart strategies can help you save on April

Tax Center For Advisors

Tax Loss Harvesting with Vanguard: A Step by Step Guide

Tax Economics in Action: When—and When Not—to Take Gains

Invest for after-tax returns

Tax-Loss Harvesting Core Bonds

pH Balancer - Mother Earth Labs

New London and southeastern Connecticut News, Sports, Business, Entertainment and Video

The North Face '95 Retro Denali Jacket

The best interactive curriculum for online ESL teachers – Abridge Academy

Spirit Linen Bed Sheets Queen Size - Pure Microfiber 4

Spirit Linen Bed Sheets Queen Size - Pure Microfiber 4 Black/Pink Stripe Skull Stockings – ShirtsNThingsAZ

Black/Pink Stripe Skull Stockings – ShirtsNThingsAZ- 6 Pack Everlast Mens Boxer Briefs Breathable Cotton Underwear For Men - Cotton Stretch Mens Underwear : Target

Petite Fleur Open-Cup Bra With Pull Out Cup

Petite Fleur Open-Cup Bra With Pull Out Cup- Jana Shores-Independent CAbi Consultant

Size Guide Australia, Buy affordable women's clothing online

Size Guide Australia, Buy affordable women's clothing online